From the first glance, all prepaid debit cards look and work the same way. However, to choose the right card for yourself, you have to examine each provider’s distinctive features and pricing in more detail. Take your time before you make a decision – if you choose wisely, your card will serve not only as a convenient financial instrument but also as a budgeting and money saving tool.

Mind that the cheapest rarely means best – and this remains true for the prepaid card industry. In order to balance the costs and features, you should look deeper than the card issuing price and monthly/yearly fee.

We know it’s easy to get lost when looking at numerous seemingly similar prepaid cards. Don’t worry – we are here to help you with the choosing.

Why Get a Prepaid Debit Card?

If you are looking for a card that gives you the same functionality as a regular debit card, but is not connected to any local bank, prepaid debit cards are made for you. These cards give you maximum control of your assets – you can load the necessary amount of money directly onto the card and spend only what you have loaded. Prepaid cards also do not influence your credit rating.

Prepaid debit cards partner with major credit and debit card companies, such as Mastercard and Visa, so they can be used in the same places where these major credit cards are accepted.

A prepaid card is a reasonable solution for people who are trying to limit their spending or manage their debt. This is also a good option for giving pocket money to your kids – because you control how much money you load on the card, they can never exceed their budget.

Compare Fees & Charges

By using prepaid debit cards, you avoid bank fees; however prepaid debit card companies have their own fees to consider. Don’t fall into the trap of thinking that some prepaid cards are free – card companies are not running a charity, so you have to be clear what you are paying for. In fact, commissions are often the main difference among prepaid card providers, as they can be very similar in the features they offer.

Some fees are pretty straightforward, like monthly fee or card issuing fee. However, there are some more obscure ones that many customers don’t know about:

- Commissions for online purchases

- Commissions for store purchases

- Cash withdrawal (up to € 250 and up to € 500)

- Money transfer to another account

- Funding options – from a bank or from another account of the same provider

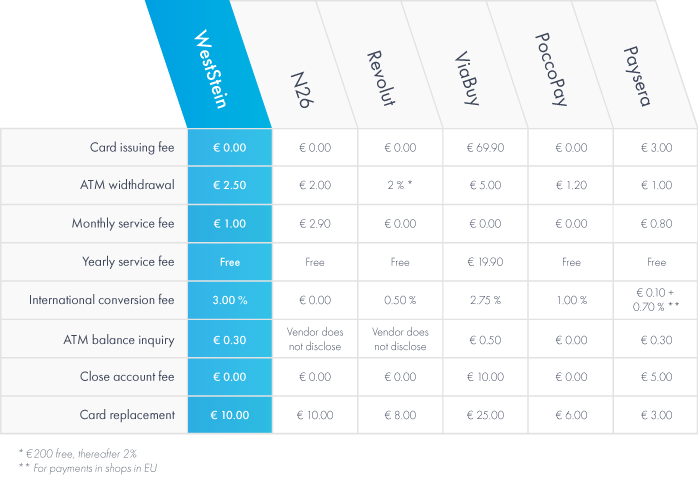

To help you out, we’ve prepared a comparison chart of the leading prepaid card providers. For a complete overview of each card’s pricing, check their websites.

As you can see, prepaid debit cards include different fees and costs. Some charge monthly service fees and fees for receiving paper statements. Some offer to waive the monthly fee if you perform a certain number of transactions with the card monthly. Some have no card issuing fee but have a higher monthly service fee or other costs.

As you can see, prepaid debit cards include different fees and costs. Some charge monthly service fees and fees for receiving paper statements. Some offer to waive the monthly fee if you perform a certain number of transactions with the card monthly. Some have no card issuing fee but have a higher monthly service fee or other costs.

ATM withdrawal pricing is an important point of reference. For example, if you know that you’ll want to use your Mastercard abroad, you might want to check the card provider’s international ATM usage pricing. Some debit card providers charge fees in addition to those charged by the ATMs. Some prepaid debit cards are part of ATM networks and have no fees if you use their machines.

Features & Funding Options

Some features are common to all or almost all prepaid cards, for example:

- An online account

- Text alerts

- Absence of credit checks

- Smartphone apps

- Option to have your salary directly transferred into your account

However, several providers offer more advanced features such as rewards programs and savings accounts. Also, some cards are more versatile in terms of funding. For example, WestStein Prepaid Mastercard is the only card that can be funded with vouchers available in Narvesen shops all over Latvia.

WestStein also uses a fast and flexible verification process – customer identity is verified from scanned documents; therefore there is no need to submit your documents in person.

When choosing your perfect card, it’s crucial to make sure it offers several ways of adding money to your account. Also, check if your daily deposit, withdrawal, and spending limits suit your financial needs. Always read through the customer agreement or website information before signing up for your card.

Customer Support

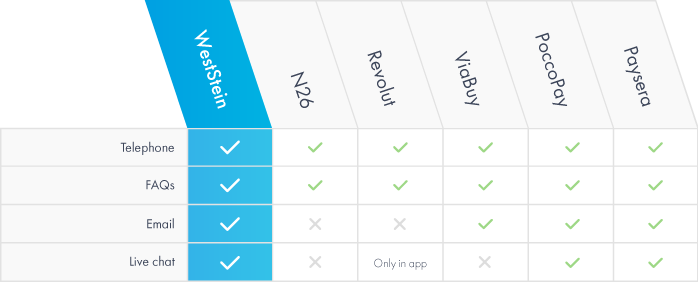

The availability of customer support can be essential when you find yourself in a financial emergency. Each of the prepaid debit cards provides several options for customer help. Make sure you check these options when choosing the most suitable card for you.

WestStein card offers all four forms of customer support – FAQs on the website, telephone, email, and live chat. There are also separate contacts for lost or stolen card and fraudulent purchases.

Choose the most functional and honest card provider

A prepaid debit card is suitable for you if you are looking for a solution to manage your finances and control your spending.

The best of these cards have useful features, like smartphone apps, multi-user access and a flexible application and verification process. The best cards also offer many different ways for you to load money onto the card.

When choosing your card, make sure you know all the costs and check for any hidden fees. While some card providers initially claim their service is free, usually there are obscure costs that can even amount to a higher price than the card issuing fee asked by other providers. WestStein practices an honesty policy and is open about all the fees and commissions of their prepaid Mastercard.

EN

EN

es

es ru

ru de

de pl

pl lv

lv it

it fr

fr nl

nl et

et hi

hi