Meet Weststein Pro!

An unlimited debit card!

Faster, more cost-effective, and convenient!

Get a Debit Mastercard with your Lithuanian IBAN account

Get your virtual debit card in 5 minutes from registration

Pay, shop and receive salary in EUR currency

Why we are loved

Weststein app

Access Your Account via Online Customer Portal or The WestStein Mobile Application.

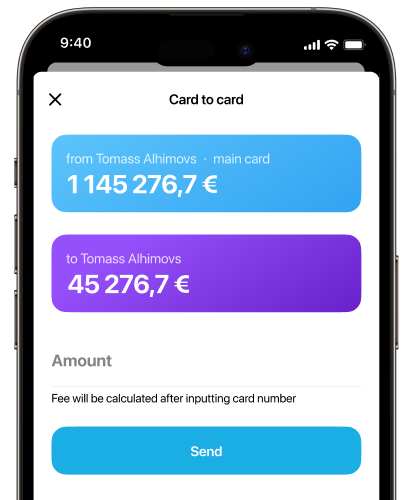

- Avoid overspending by following your budget

- Make instant tranfers to another WestStein card

- View and export transaction history wherever you are

Get the Weststein app directly on your phone:

Tap away with Apple Pay

Connect your card to enable tap and pay with your phone. There’s no need to wait for your physical card to arrive.

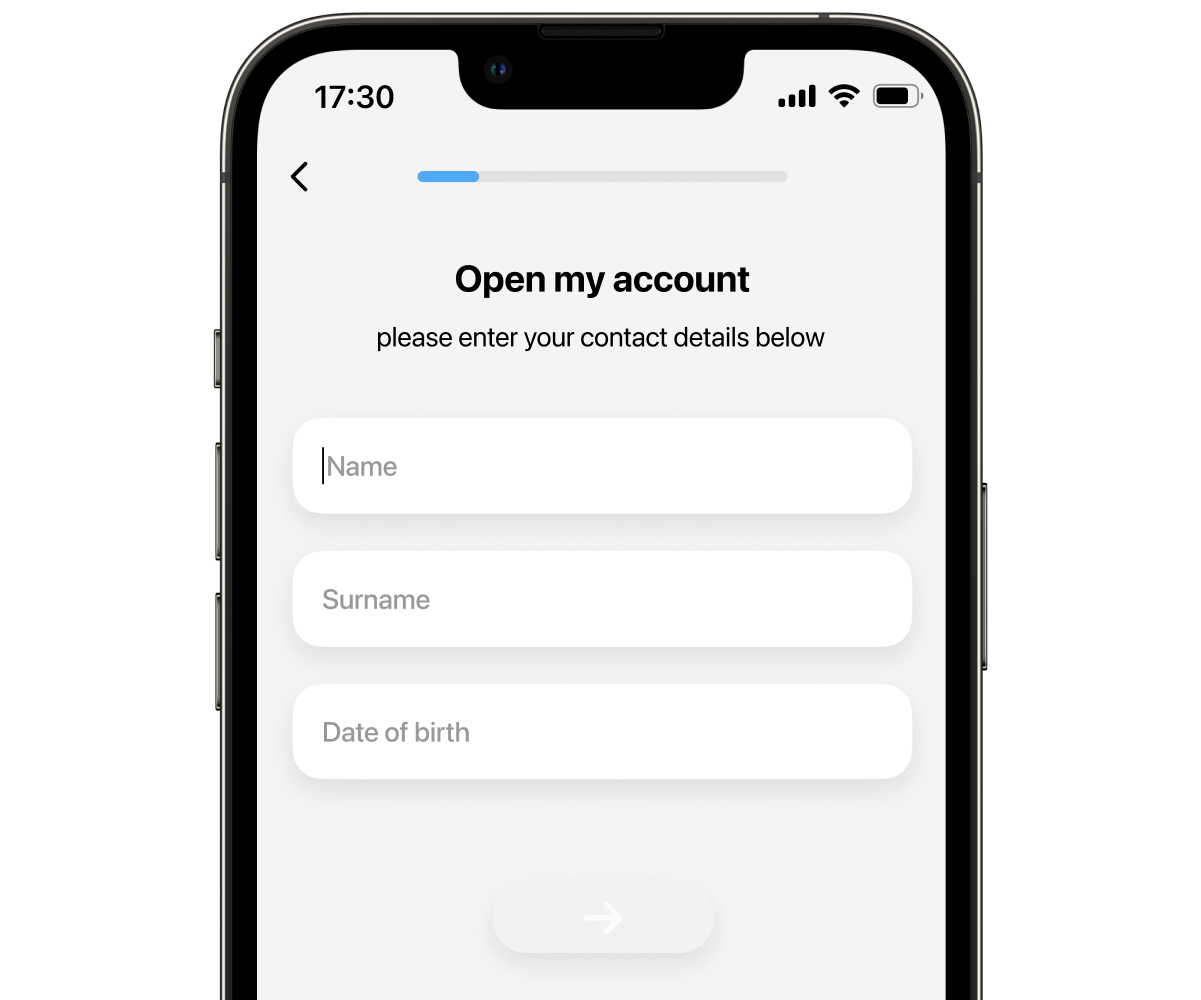

How it works

Access Your Account via Online Customer Portal or The WestStein Mobile Application

1

Complete WestStein online signup form

2

Access your account right after registration

3

Get your virtual card in 5 minutes from registration

Designed in collaboration with Mastercard

Choose a debit Mastercard and use it at ATMs, online, and in retail stores around the globe.

41 mln

2.1 mln

locations

ATM's worldwide